Introduction: Deciphering the Aterso01 Letter

Receiving correspondence from the Aterso01 debt collection agency can trigger a range of emotions, from concern to uncertainty, about its potential implications. It’s entirely natural to experience these feelings, especially given the gravity often associated with such communications. This initial sense of apprehension underscores the critical importance of understanding the contents of the letter and formulating an effective response strategy. After all, safeguarding your financial well-being hinges upon your ability to navigate and address the situation adeptly.

Upon receiving a letter from Aterso01, individuals are often confronted with a myriad of questions: What does this communication entail? What are the implications for my financial standing? How should I respond to ensure my rights and interests are protected? These inquiries underscore the need for a comprehensive understanding of the contents of the letter and the subsequent steps to be taken.

At the heart of this matter lies the significance of informed decision-making. Without a clear grasp of the contents and implications of the letter, individuals may inadvertently jeopardize their financial stability. Conversely, a well-informed response can empower individuals to address the situation effectively, mitigate potential risks, and assert their rights in the face of debt collection activities.

Therefore, embarking on this journey of understanding begins with dissecting the intricacies of the letter from Aterso01. By unraveling its contents, deciphering its implications, and formulating an informed course of action, individuals can proactively protect their financial interests and navigate the complexities of debt collection with confidence. Let’s delve deeper into the nuances of this process, equipping you with the knowledge and tools necessary to navigate this terrain effectively and safeguard your financial well-being.

Unveiling Aterso01: Investigating its Origins and Practices

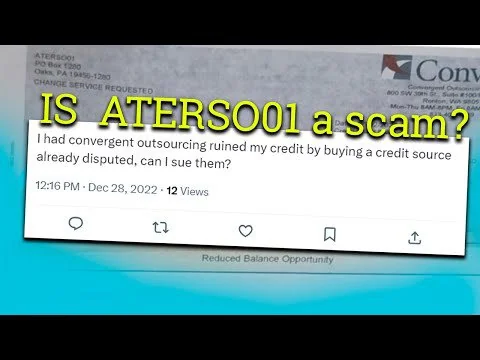

Aterso01 Unmasked: Aterso01, also known as Aters001, has garnered attention and raised eyebrows within the debt collection industry due to its controversial practices. While it claims to be a legitimate debt collection agency, concerns have arisen regarding its operations and affiliations.

Legitimacy Concerns: Numerous complaints and allegations have surfaced, casting doubt on the legitimacy of Aterso01. Questions have been raised about its connection to other entities and the transparency of its debt collection practices.

Analyzing Aterso01: A Methodological Approach

Research Methodology: To provide a comprehensive analysis of Aterso01, we employ a rigorous research methodology. This involves gathering data from various sources, consulting industry experts, and verifying information to ensure accuracy and reliability.

Transparency in Reporting: Maintaining transparency in our reporting is paramount. All information presented in this guide is sourced from credible sources and publicly available data, with proper citations provided for transparency and accountability.

Unraveling the Aterso01 Mystery: Is it a Scam?

Scam Allegations: Despite Aterso01’s claims of legitimacy, concerns have been raised about its practices. While it may not fit the traditional definition of a scam, allegations of questionable tactics and lack of transparency have led to skepticism among consumers.

Critical Evaluation: It’s essential to critically evaluate the evidence and consider multiple perspectives when assessing Aterso01. While negative reviews and accreditation status may raise red flags, definitive conclusions should be based on thorough investigation and analysis.

Investigating the Aterso01 and Convergent Outsourcing Connection

Shared Traits: Aterso01 shares several similarities with Convergent Outsourcing, including a shared headquarters address and website domain. These connections suggest a potential relationship between the two entities.

Divergent Aspects: Despite these parallels, there are notable differences between Aterso01 and Convergent Outsourcing. While they may share certain operational elements, distinct characteristics and practices set them apart, warranting further examination.

Navigating Aterso01’s Practices: What You Should Know

Verification Protocol: When dealing with communications from Aterso01, it’s crucial to verify the authenticity of the correspondence. This may involve researching the agency, confirming the validity of the debt, and seeking legal advice if necessary.

Debt Validation: If you’re unsure about the legitimacy of a debt, you have the right to request validation from Aterso01. This process allows you to verify the accuracy of the debt and ensure that it’s legitimate before taking any further action.

Understanding Online Scam Tactics and Protective Measures

Scam Tactics: Online scammers often employ deceptive tactics to manipulate individuals and extract money or personal information. Recognizing common scam tactics and understanding how to protect yourself is essential for safeguarding your financial well-being.

Preventive Measures: Protect yourself from online scams by remaining vigilant, avoiding unsolicited communications, and verifying the legitimacy of offers or requests. Educating yourself about common scam tactics and exercising caution can help prevent falling victim to fraudulent schemes.

Safeguarding Your Financial Well-Being Against Debt Collection Agencies

Credit Repair Strategies: If your credit has been negatively impacted by debt collection activities, there are steps you can take to repair your credit and mitigate the damage. This may include disputing inaccuracies on your credit report, negotiating with creditors, and seeking professional credit repair services.

Vigilance and Action: Stay informed about your rights and options when dealing with debt collection agencies like Aterso01. By understanding your rights under consumer protection laws and taking proactive steps to address any issues, you can protect yourself from deceptive practices and safeguard your financial future.

Conclusion

Navigating the complexities of debt collection agencies like Aterso01 requires diligence, awareness, and informed decision-making. By understanding their practices, exercising caution, and leveraging consumer protection measures, individuals can protect themselves from deceptive practices and assert their rights effectively. Remember, knowledge is your most powerful tool in safeguarding your financial well-being, so stay informed and take proactive steps to protect yourself from potential risks.

Frequently Asked Questions About Aterso01

1. What is Aterso01?

Aterso01 is a multifunctional platform designed to streamline various tasks and processes. It combines features such as task management, communication tools, and data analysis to enhance productivity and efficiency in different settings.

2. How does Aterso01 improve productivity?

Aterso01 offers a range of productivity-enhancing features such as task prioritization, collaborative task management, real-time communication channels, and data visualization tools. By centralizing these functions within a single platform, Aterso01 minimizes the need for switching between multiple applications, thus saving time and reducing distractions.

3. What industries can benefit from using Aterso01?

Aterso01 is versatile and adaptable, making it suitable for a wide range of industries and professions. It is particularly beneficial for teams and organizations involved in project management, software development, marketing, education, and remote work setups. Its customizable features cater to the unique needs of different sectors, facilitating smoother operations and better outcomes.

4. Is Aterso01 secure?

Security is a top priority for Aterso01, and robust measures are in place to safeguard users’ data and privacy. The platform employs encryption protocols, access controls, regular security audits, and compliance with industry standards to ensure the confidentiality, integrity, and availability of sensitive information.

5. How can I get started with Aterso01?

Getting started with Aterso01 is simple and straightforward. Users can sign up for an account on the Aterso01 website or through the mobile app. Once registered, they can explore the platform’s features, customize settings to suit their preferences, and invite team members to collaborate. Aterso01 offers various subscription plans, including free and premium options, allowing users to choose the option that best fits their needs and budget.